Malaysia’s domestic banks demonstrated improved financial performance in the second quarter of 2024 (2Q24), according to RAM Ratings. This growth was largely attributed to a slight recovery in net interest margins (NIMs) and reduced provisions.

Eight RAM-rated local banking groups, including Affin Bank Bhd, Alliance Bank Malaysia Bhd, AMMB Holdings Bhd, CIMB Group Holdings Bhd, Hong Leong Bank Bhd, Malayan Banking Bhd, Public Bank Bhd, and RHB Bank Bhd, saw their average pretax return on assets rise to 1.41% in 2Q24. This is an increase from 1.37% in the previous quarter and 1.39% in 2Q23.

“Following significant compression in NIMs during 2023 due to delayed repricing of deposits from policy rate hikes and stiff competition, banks experienced some relief in the first half of 2024 (1H24),” said Wong Yin Ching, co-head of Financial Institution Ratings at RAM. Banks effectively managed their funding costs by reducing reliance on expensive deposits, leading to improved margins.

The average NIM for the eight banks increased by two basis points quarter-on-quarter, reaching 2.05% in 2Q24.

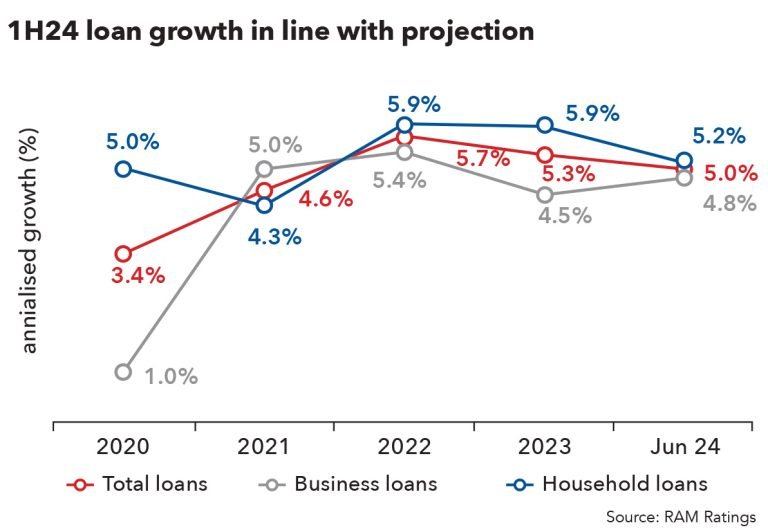

Loan growth in the banking sector remained strong, with an annualised rate of 5% for 1H24, aligning with RAM Ratings’ full-year projections. Household loans outpaced business loans, growing by 5.2% compared to 4.8%, while residential mortgage growth remained robust at 6.7%. Passenger vehicle hire purchase loans surged by 9.6%.

Business loans, which rebounded in late 2023, continued to grow steadily in 1H24, supported by Malaysia’s strong economic performance. The banking system’s gross impaired loan (GIL) ratio dropped to 1.60% by the end of June 2024, from 1.65% at the end of December 2023.

Wong added, “Malaysian banks’ strong asset quality continues to support their solid credit fundamentals.” With unemployment rates returning to the pre-pandemic level of 3.3%, favorable labor market conditions are expected to mitigate the impact of subsidy cuts.

RAM Ratings anticipates the GIL ratio will remain between 1.6% and 1.7% by the end of the year. The annualized credit cost ratio for the eight banks dropped to 18 basis points (bps) in 2Q24, compared to 22bps in 1Q24 and 23bps in 2023. GIL coverage, including regulatory reserves, stood at 137%, significantly higher than the 107% recorded in 2019.

RAM Ratings projects the credit cost to remain low at around 20bps for the full year, thanks to the substantial management overlays maintained by banks.