If you’re planning to apply for a personal loan with Maybank, you’re likely wondering: “How long does Maybank approve a personal loan?” Understanding the approval process and timeline can help you plan better — especially if you need funds urgently.

In this post, we break down the typical approval time for a Maybank personal loan, what factors can affect it, and how to speed up your application.

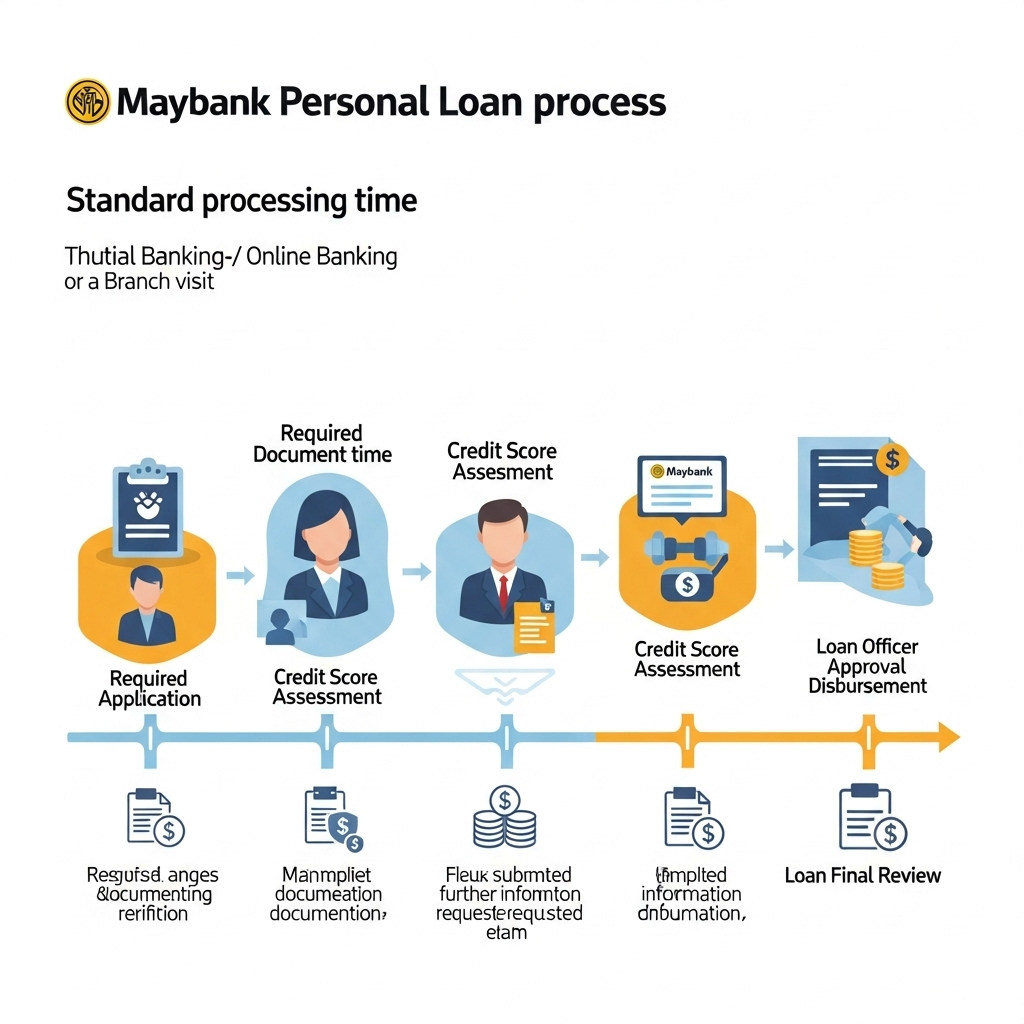

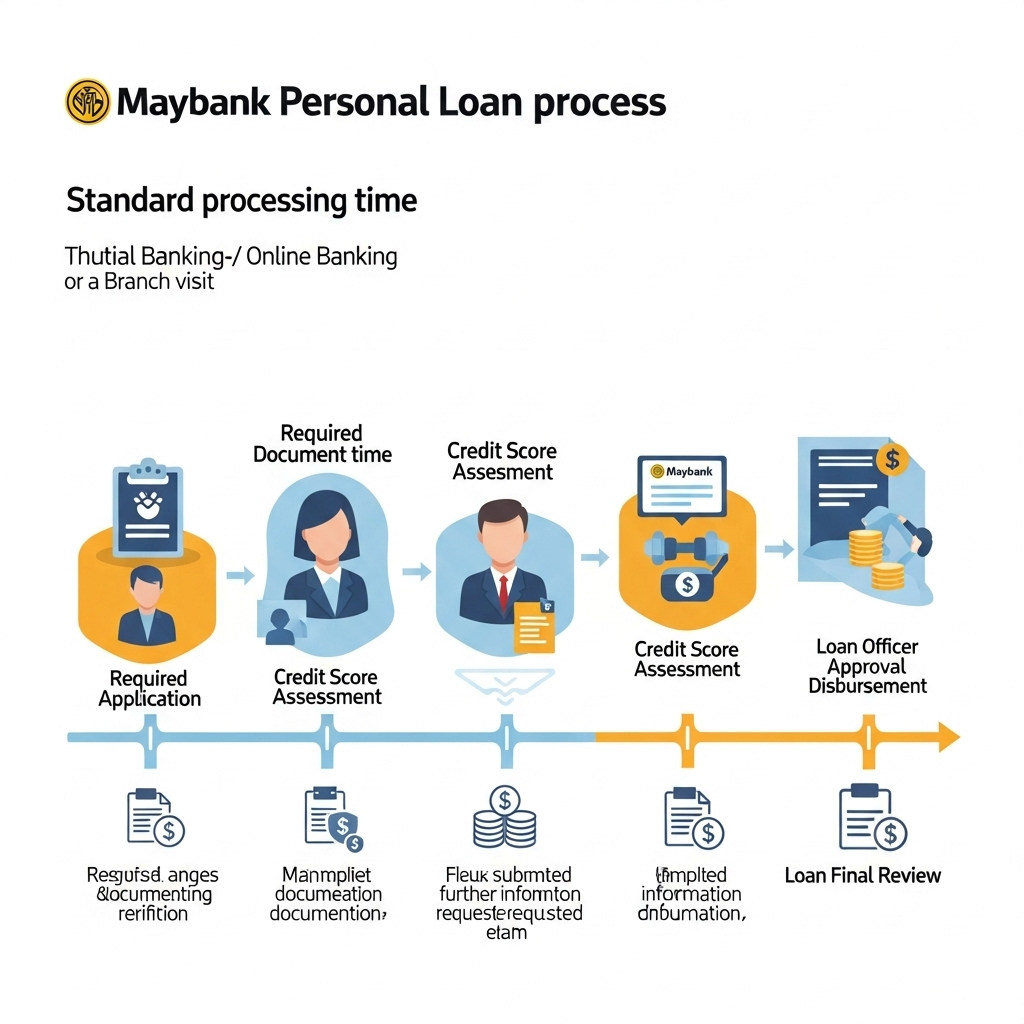

Maybank personal loan approval generally takes 24 to 48 hours after submission of complete documents. However, the actual processing time can vary depending on several factors:

| Loan Type | Estimated Approval Time |

|---|---|

| Maybank Personal Loan | 1 – 2 working days |

| Maybank Islamic Personal Financing-i | 1 – 3 working days (especially for government servants via Biro Angkasa) |

| Online Application via Maybank2u | Often faster – within 24 hours if documents are complete |

While Maybank aims to process loan applications quickly, the following factors may impact the approval duration:

Missing or unclear documents are the most common reason for delays. Ensure your:

Maybank reviews your CCRIS/CTOS reports to assess your creditworthiness. Poor credit records or active defaults can lead to longer processing or even rejection.

Maybank may contact your employer for confirmation. If verification is delayed (e.g. weekends or public holidays), approval may be postponed.

Applying online via Maybank2u may result in faster approval compared to manual branch submissions.

If you need urgent approval, follow these tips:

✅ Submit a complete application – Double-check all required documents

✅ Maintain a clean credit report – Clear overdue payments beforehand

✅ Apply during weekdays – Applications are usually processed on business days

✅ Use Maybank2u – Faster digital processing for existing customers

Once approved, Maybank typically disburses the loan within the same day or next working day, directly into your Maybank account or the bank account you’ve selected.

So in total, from submission to disbursement, it can take 2 to 5 working days if there are no issues.

So, how long does Maybank take to approve a personal loan?

The simple answer: Within 1–2 working days for most applicants — provided all documents are in order and your credit standing is healthy.

Need cash fast? Be proactive, submit everything clearly, and apply online via Maybank2u for the fastest turnaround.

To increase your chances of qualifying for a Maybank personal loan:

You can apply for a Maybank personal loan through:

So, how do you qualify for a Maybank personal loan? It all comes down to meeting the bank’s income, employment, and credit score requirements. With the right preparation and documentation, you can enjoy a fast and smooth approval process.

If you’re ready to apply or want to explore your options, visit the official Maybank Personal Loan page for the latest rates and promotions.